As mortgage brokers, one of the most common questions we are asked is: “How can I reduce mortgage payments?”

So we sat down and distilled what we do into this guide, “10 ways to reduce mortgage repayments“.

Your mortgage consists of:

- principal – the amount you borrowed to buy your home

- interest – the amount you pay your lender and

- fees for arranging and having the mortgage facility

The interest on a mortgage is substantial because you are borrowing over such long periods of time.

For example a standard variable 25 year loan of $350,000 at 6.25% interest would cost $692,652.85 – with nearly half the total cost being interest.

To see the cost of your home loan use this Home Loan Calculator.

To really slash years off your mortgage, you need to minimise interest in three ways:

- Pay a lower interest rate (rate)

- Minimise your loan balance daily (balance)

- Borrow over a shorter period (duration)

There are a number of strategies to reduce mortgage repayments by minimising the rate, balance and duration. The key is to find the right mix of strategies which best fit your circumstances.

10 Ways to Reduce Mortgage Repayments

Rate (and Fee) Strategies

-

- Consolidate high interest personal debt into your variable loan within your mortgage AND continue to make those high personal repayments. You should aim to clear the personal debt off within 1 to 5 years. This is great for car loans and credit card debt where the interest rate can be over 9% compared to a mortgage rate currently around 4%.

- Take advantage of lenders’ discounts to the base rate e.g. professional occupation discount, lender packages, multiple accounts discounts and introductory (honeymoon) rates. If you choose a honeymoon rate you must check you can afford the repayments once the introductory period ends.

- Fix a proportion of your loan when rates are low and expected to rise. Still have a variable part of your loan to pay any windfalls into (to get your loan balance down) and to give you a buffer in case of any unexpected expense.

- Don’t pay lenders mortgage insurance (LMI) if you can avoid it. LMI is a non-refundable one off fee added to your mortgage if you don’t have a 20% home deposit. LMI is there to protect the lender NOT you so there is no benefit of you of having this expensive cover.

- Refinance for a better overall deal. To get ahead on your mortgage you want a significant saving on your interest rate with a package suited to your life style and circumstances without paying a fortune in fees.

Despite a surge in smaller lenders offering mortgage rates under 4.00%, borrowers are wasting $17 million a day by sticking with big bank lenders instead of switching to a cheaper home loan, according to a study by Mozo1. All lenders – banks, building societies and credit unions – operate under the same laws, rules and regulations for credit transactions in Australia. When refinancing appraise a number of lenders – a good way to do this is to talk to a reputable mortgage broker for a free no obligation consultation.

Balance Strategies

- Pay windfalls or savings into your mortgage rather than into a lower interest savings account. Choose an account with no withdrawal fee if you need to access that money later.

- Get an offset account or revolving line of credit:

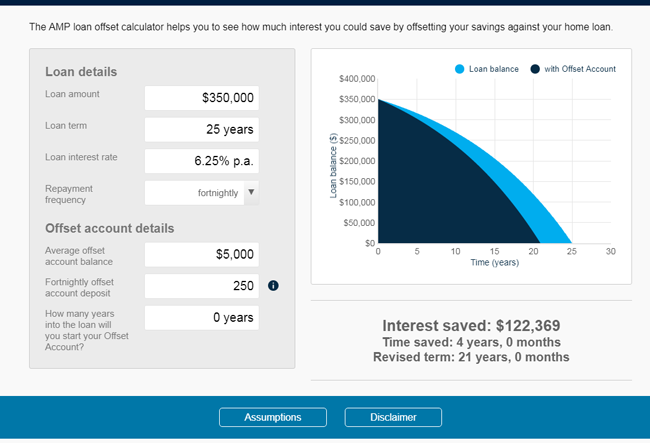

With an offset account, any amount in your savings account is offset against your mortgage balance daily so your interest is charged on a smaller balance. Use the offset calculator to see how much you could save with an offset account.

Revolving line of credit account – similar principle to an offset account. The line of credit (LOC) allows you to borrow to a pre-set ceiling. A LOC is great where you want flexibility e.g. to undertake major renovations without needing to arrange a new home loan. You need to be very disciplined to continue to pay off your line of credit account as many lenders require interest only repayments for the first 10 years which means that you have to significantly increase your payments later in the loan term and you will pay more in total. As they are riskier, lines of credit often:

Duration Strategies

- Finance over the shortest loan period you can comfortably afford – you pay considerably more interest on a 30 year loan over a 25 year loan. Bear in mind that interest rates are at historic lows so that they are going to increase over a 20+ year period. You need to know how comfortable you would be at making repayments if interest rates were at 6% to 9% (more typical long term levels).

- Shorten your loan period without refinancing. Use the calculator to find out the monthly repayments needed to pay your mortgage off a few years earlier. Make payments at this higher level. This will build up a buffer should you need to reduce mortgage repayments later e.g. because of redundancy or for a big ticket expense like a wedding.

- Make loan payments fortnightly, or weekly if you can. As interest is charged daily the effect of changing from monthly to weekly payments is considerable over the full loan period. It is best to set up a direct debit for your mortgage payments to synchronise with your salary so that your mortgage is always covered and not spent elsewhere. Furthermore, when changing over to fortnightly loan payments divide your monthly loan payments in two and you will end up paying another month off your mortgage each year.

As you can see there are a number of ways to reduce mortgage repayments. Some you can adopt straight away and others will need the help of professional. The most important thing is to just get started as every dollar extra you put into your mortgage now could save you up to two dollars in the long run.

1 Mozo Media Release 30/10/15

This article was written by Andrew Maurer and Janine Leafe, accredited and licensed mortgage brokers at Approved Financial Planners. If you are in Perth and want a free no obligation chat about reducing your mortgage repayments call us on 6462 0888.

This information is general in nature and should not be relied upon without financial advice tailored to your personal circumstances. Please refer to the Product Disclosure Statement before you purchase any financial product.