Financial planning, in Perth and across Australia, is a field that is constantly evolving. Recently, Dr Shane Oliver, Chief Economist and Head of Investment Strategy and Economics at our parent company, AMP Capital, published a wealth of information on active asset allocation.*

We would like to share some of the information with you to help you understand the importance of allocating your assets correctly.

Overview

In the long term, growth assets such as shares can provide huge returns due to compound interest. However, growth assets regularly go through periods of high volatility. This causes some investors to react to periods of low value by selling these assets off and resorting to cash investments, which don’t often produce losses but don’t produce long term returns, either.*

The key, according to Dr Oliver, is to use one of two strategies. The preferred strategy is to stick with assets for the long term and take advantage of the growth. However, Dr Oliver also recommends what he calls a “rigorous approach to dynamically varying the asset mix” if one can’t hold onto an investment long term or wants to take advantage of cyclical swings in the markets.*

Introduction

In Australia, from 1982 until the Global Financial Crisis (GFC) in 2007, shares were in what Dr Oliver calls a “bull market.” Most classes of assets produced ample returns, so the asset mix wasn’t seen as important. Many didn’t want the hassle of actively managing their portfolios, so they didn’t pay attention to the asset mix. However, the GFC forced investors to look at the asset mix as an integral part of an investment portfolio.*

Dr Oliver recommends the long-term approach because so many investors don’t have the time it takes to actively manage asset allocation. However, he does believe that a “rigorous approach” will allow investors to profit from changing their asset mixes to react to and anticipate market cycles.*

Investing: Some Surprising Numbers

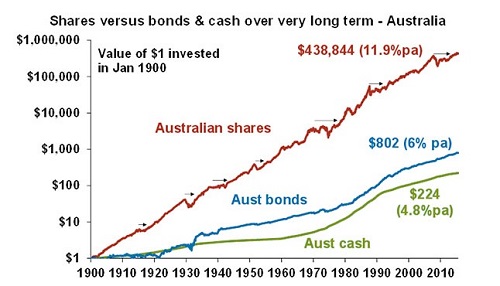

Dr Oliver provided a graph showing what $1 invested in 1900 would be worth now if all interest and returns were reinvested the same way. The numbers provide a “graphic” understanding of the power of compounding when added to the returns of the markets. They also show just how badly cash investments “perform.”*

Source: Global Financial Data, AMP Capital

Source: Global Financial Data, AMP Capital

$1 invested in Australian cash and put in a bank in 1900 would have compounded to $224 with an average return of 4.8% per annum. $1 invested in bonds would be worth $802 today at 6% per annum. Those numbers sound pretty good, right? If that $1 had been invested in Australian shares, it would be worth $438,844 at 11.9% per annum.*

Does this give you a grasp of just how powerful long-term compounding is? According to Dr Oliver, “Over all rolling 40 year periods and virtually all 20 year periods, shares trump bonds and cash.”*

It’s all Cyclical

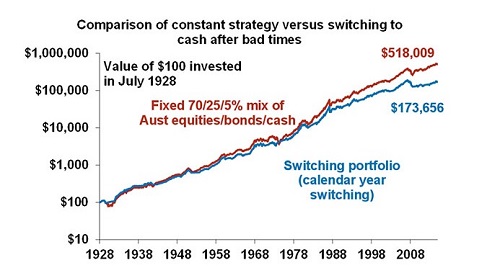

We won’t begin to try and explain it all here, but we want to give you a few highlights. The markets go through cycles. They tend to crash during times of extreme stress, such as world wars, the oil crisis of 1972-74 and the GFC. Many investors convert to cash in times of duress and then back to shares when the crises pass. While this sounds like a great investment, Dr Oliver compares a balanced fund to a fund which reallocates assets to cash.*

Source: Global Financial Data, AMP Capital

Source: Global Financial Data, AMP Capital

If $100 was invested in July 1928, a balanced fund consisting of 75% Australian Equities, 20% bonds and 5% cash, and left intact no matter what the crisis, it would be worth $518,009 today. If that same fund used conventional “switching” according to calendar year, meaning it was flipped to solely cash after any negative year and back to a balanced fund after the next positive year, it would be worth $173,656.*

This illustrates how accurate and adept an investor must be to profit from asset allocation.*

Obtain Expert Financial Advice

At Approved Financial Planners, we not only have more than 40 years of financial planning experience in the Perth area, we also have the resources of AMP Capital behind us. To learn more or for an individual consult, call us today: 08 6462 0888.

AMP Capital. “The perils of switching–why active asset allocation makes sense but why it needs to be done properly.” Dr Shane Oliver.

https://www.ampcapital.com.au/article-detail?alias=/olivers-insights/august-2015/the-perils-of-switching-why-active-asset-allocat